An innovative stainless material achieves a lower total cost of ownership and extended service life, compared to other stainless offerings, improving ROI and profitability of fracing operations.

Hydraulic fracturing is starting to re bound. Nevertheless, profitable fracing will depend on finding ways to reduce and control production costs. One of the big, recurring expenses is the fluid ends, whose cost is driven by the metal forging. Finkl Steel viewed this as an opportunity to innovate a new material, formulated especially for fracing applications, to im prove economics.

In 2019, Finkl launched a new fluid end material, HVX Stainless, to lower the total cost of ownership and improve ROI, compared to other fluid end materials, specifically 17-4PH and 15-5PH stain less varieties. Finkl’s metallurgists set out to develop the ideal chemistry for fracing applications by optimizing for total cost of ownership and ROI by focusing on af fordability, pump life, machining costs and repairability. Beyond the chemical composition, the company launched an ini tiative to determine how, and where, the new stainless is forged, to offer the short est lead times and ensure consistent qual ity. The company also wanted to supply with U.S.-made forgings, while avoiding international tariffs. Thus, the new stainless material is intended to enable more oil and gas companies to frac profitably and resume their operations sooner.

Uncertain economics necessitate new stainless material to improve abrasion resistance. Until a few years ago, the dominant fluid end blocks were made from variations of 4330 non-stainless alloys. While these are good at resisting abrasion, their field life is limited, because they would crack from corrosion. The industry experimented with off-the-shelf 17-4PH and 15-5PH stainless steels, and learned that they provided more than two times the field life, compared to the 4330 varieties—even though 17-4PH and 15- 5PH measured lower in strength, abrasion resistance, and impact properties. While 17-4PH and 15-5PH stainless cost more, their longer life and reliability improved ROI. The improvement in corrosion resistance mattered more, and 17-4PH and 15-5PH stainless quickly became the go-to fluid end material of choice.

However, 17-4PH and 15-5PH stain less were never formulated specifically for hydraulic fracturing applications. They contain excessive concentrations of certain expensive and market-volatile elements, such as nickel and copper. Greater concentrations of these don’t enhance performance in fracing environments beyond a certain point. For instance, nickel is expect ed to become more scarce and expensive, because of increasing battery production for electric cars. As a result, this will negatively impact the cost of ownership and ROI of 17-4PH and 15-5PH stainless. In addition, several countries are already for bidding nickel to be exported, which will contribute to supply and price volatility. While the improved service life of 17- 4PH and 15-5PH blocks can be credited to the corrosion resistance of stainless steels versus alloy steels, their strengthening mechanisms still leave them vulnerable to premature wear from abrasion and erosion, even at high hardness levels. Many of today’s shale formations require greater pressures and highly abrasive proppants, such as bauxite. These conditions reduce pump block life and make washout one of the most common failure modes of stain less blocks. Off-the-shelf 17-4PH and 15-5PH stainless were never designed for fracing applications. There are opportunities to address the greater expense of these materials and the field vulnerabilities that arise from using higher pressure and more abrasive proppants for fracing applications.

Metallurgists identify precise formu la for difficult fracing applications. To develop HVX stainless, Finkl’s metallurgists researched the different stainless alloy families and tested many variations in chemistry. They found the ideal mix and concentration of elements that brings out the best properties of both carbide strengthened martensitic stainless steels, such as 410, and precipitation-hardening (PH) stainless steels, such as 17-4PH and 15-5PH.

PH stainless grades achieve their strength through sub-micron copper and intermetallic precipitates that form in the steel matrix during heat treatment. These small particles may be excellent at providing strength in tension (i.e. high “yield strength” or “ultimate tensile strength”), but they have limited effectiveness in protecting the steel against abrasive wear or erosion. This limited wear resistance can make even a high-strength PH steel prone to washout. Additionally, when the steel wears away, the protective oxide layer that prevents corrosion and makes the steel “stainless” also wears away, and this can again leave steel vulnerable to corrosion related failures.

HVX is a carbide-forming precipitation hardening martensitic stainless. Carbide strengthening is a fundamentally different mechanism that benefits from hard particles, i.e. metal carbides, providing strength. Unlike submicron copper particles, these metal carbides provide excellent resistance to wear. This gives the new stainless increased washout resistance compared to 17-4PH and 15-5PH. Unlike traditional carbide-strengthened stainless steels like 410, the new stainless also uses precipitation strengthening to achieve excellent through-hardenability. The combination of strengthening mechanisms means excellent properties from surface to center, even in the large cross-sections of frac blocks.

Smarter about being harder. When evaluating stainless steels for an applica tion, engineers often look at the pitting resistance equivalent number (PREN). The PREN is calculated from the chromium (Cr), molybdenum (Mo) and nitrogen (N) content of the steel. These elements contribute to form the passivating layer on the surface of the steel that protects it from corrosion and makes it “stainless”. On paper, higher PREN means more corrosion resistance. But it’s important to under stand that PREN, alone, does not predict corrosion in actively abrasive or erosive environments, which are the real-world conditions of fracing. High PREN combined with low abrasion resistance can result in the same life as low PREN and high abrasion resistance. The new stainless has the benefits of the passivating Cr and Mo oxide film and the wear resistance of Cr and Mo carbides—it has high PREN and high wear resistance.

To put this theory to the test, the company put its new stainless steel up against a traditional 17-4PH alloy in third-party erosion and corrosion-erosion testing. The new samples had been heat-treated to 110-ksi tensile strength, while the 17-4PH had been heat treated to 155-ksi tensile strength (ASTM A705 type 630 H1025 condition). In other words, the 17-4PH was heat-treat ed to a much higher hardness. Despite the conventional wisdom that higher hardness means higher wear resistance, HVX demonstrated significantly less mass loss (i.e. significantly better wear resistance), both in pure erosion (abrasive wear in pure water) and in erosion-corrosion (abrasive wear in saltwater). In fact, when subjected to abrasive wear in a corrosive environ ment, the new stainless demonstrated less than half the mass-loss rate of the harder 17-4PH material.

Stainless uses the exact combina tion and concentration of elements to enhance performance. What Finkl’s metallurgists discovered is a new stain less formula that contains a fraction of the quantities of some of the most expensive elements while still matching, and often exceeding, the more expensive grades in fracing performance. For example, nickel makes up around 5% of a 7,500 lb-block of 17-4PH or 15-5PH stainless. What we found is that nickel at 1% concentration, together with an optimized amount of other elements and processed correctly, gives the new stainless the correct combination of properties for superior performance. The new stainless only requires 75 lb of nickel versus up to 412 lb for off-the shelf stainless.

The difference means that companies won’t need to pay for roughly 330 lb of nickel that don’t create additional service life. As prices of nickel are taking off and projected to skyrocket, the new stainless becomes the ultimate hedge against PH stainless price increases. Well service com panies and pump end manufacturers won’t pay for extra concentrations of material that only add expense, not additional per formance in the field.

Minimizing total cost of ownership maximizes ROI. With the optimized formulation for fracing, HVX has lower material costs, making it more affordable, because it contains less nickel, copper and other expensive alloys than 17-4PH and 15-5PH stainless. Nickel prices are predicted to explode, as demand for elec tric vehicles and other battery applications gains momentum. Export bans in some countries may also constrain supply, driving these prices of stainless materials even higher.

Easier and less expensive to machine. Besides the actual cost for a block, fluid end manufacturers spend a great deal of time and money on machining. The new stainless is already proven to be hard enough for the field, but it is also designed for faster machinability. HVX is saving some fluid end manufacturers over 25% on the amount of time it takes to make a fluid pump in comparison to 17-4PH and 15-5PH. Another key benefit is that it re duces their lead time to make a pump end, so they can serve well service companies even better.

The new stainless works equally well with valve-over-valve and WYE-blocks. Operators are producing both configurations with similar ease. Companies can use the stainless reliably for either and achieve the same results. This makes using the new stainless technology relatively easy to use and more cost-effective.

U.S. manufacturing reduces risk when buying stainless pump blocks. In 2013, the company installed an all-new 90-metric ton arc furnace at its Chicago, Illinois plant that has the capacity to melt 350,000 tons of steel a year. Because of its domestic origin, U.S.-based operators don’t have to contend with the complex and changing nature of global purchasing. There are never risks or worries about fluctuating currencies, political upheaval, new tariffs, quality, supply chain reliability or transportation speed.

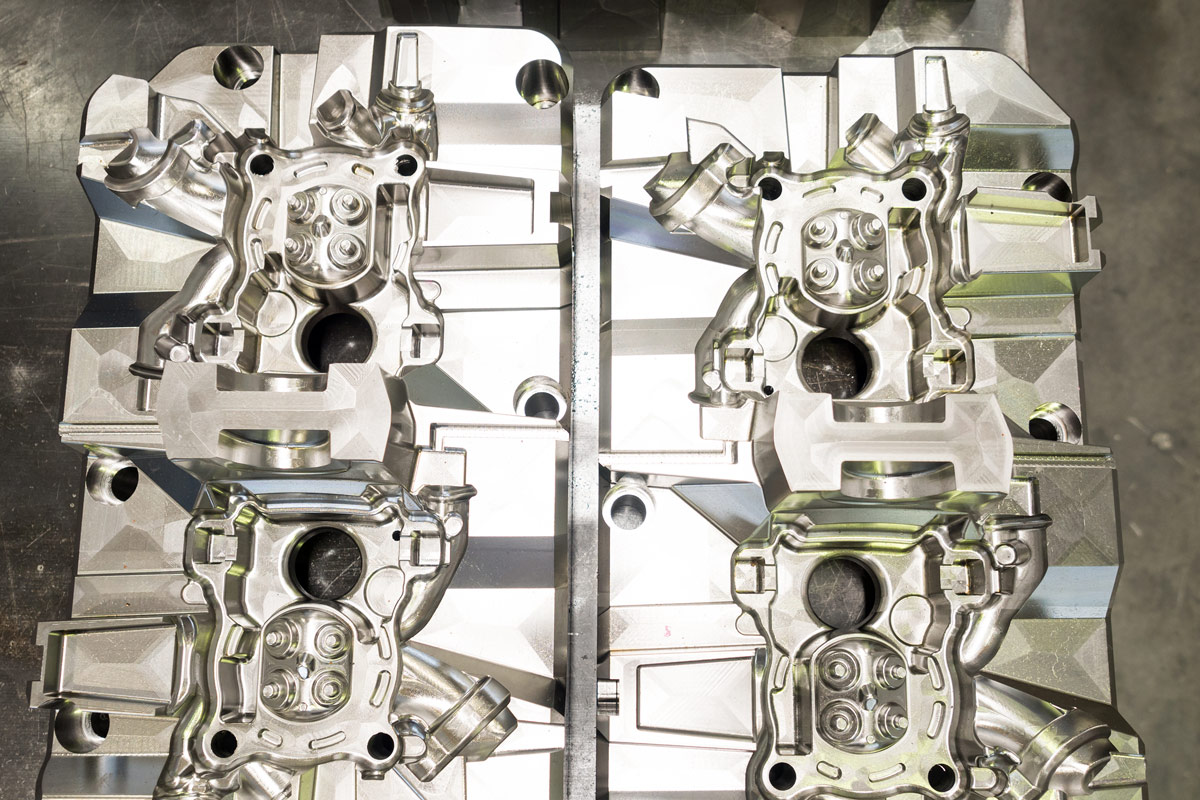

Lean manufacturing reduces cli ent inventory requirements. The company’s dedicated “lean-line” capac ity and short lead time ensure a reliable supply for production of fluid end blocks. The line was created to improve the lead time for fluid ends blocks, including the new stainless, to just seven to eight weeks. This is much faster, com pared to most forging suppliers. In addition, the lean line capacity can be flexed to produce up to 6,000 fluid end blocks per year—and can be expanded further, if required. This lean capability and frac focused approach are structured to keep up with demand while reducing price —without altering lead times or quality.

FIELD PERFORMANCE

In the field, the new stainless is achieving 1,250 to 1,500 average run time, with maximum run times longer, depending on the application. Engineers have determined, in head-to-head testing, that HVX matches and frequently exceeds the service life of 17-4PH and 15-5PH stainless fluid ends. The extended service life, combined with its cost and supply chain advantages, is how the new product achieves the lowest total cost and highest ROI of any fluid end material.

The company has over 3,200 blocks in operation and the design has been ad opted by several major pump end manu facturers. One well service company said, “HVX works best for us, based on machinability and the service life that we get out of it—and price.” A fluid end manufacturer noted “that the new stainless doesn’t have a high nickel content, making it relatively inexpensive. However, it still has enough chromium content to where it can compare and compete with industry standard stainless steel.”

Well service companies prefer to field test new material or technology to see how it performs in their real-world conditions. The lower cost and ease of machining make the stainless technology attractive for companies to determine for themselves how the new stainless performs. With short lead times, companies can seize op portunities to use the new stainless product, as they arise.

CONCLUSION

As the world emerges from the im pact of the pandemic, fracing is expected to increase. HVX’s lower price point, its lowest total cost of ownership and proven field-tested performance will enable more fracing companies to get back in the field sooner and remain profitable.

The stainless was developed to meet the economic challenges companies face, and tackle the tougher fracing applications that cause greater abrasion and washout failures of fluid ends. The material advancements give the HVX the abra sion and corrosion resistance to match or exceed 17-4PH and 15-5PH stain less. At the same time, the HVX requires significantly less of the expensive and price volatile metals, such as nickel or copper, to achieve this high level of performance.

World Oil® / JANUARY 2021